About the Company:

AGS Transact Technologies Ltd is one of the largest integrated omni-channel payment solutions provider in India in terms of providing digital and cash-based solutions to banks and corporate clients.

Company provides customised products and services comprising ATM and CRM outsourcing, cash management and digital payment solutions including merchant solutions, transaction processing services and mobile wallets.

Company is the second largest company in India in terms of (i) revenue from ATM managed services under the outsourcing model, and (ii) revenue from cash management and number of ATMs replenished.

As of March 31, 2021, company deployed 207,335 payment terminals and were one of the largest deployers of POS terminals at petroleum outlets in India, having rolled out IPS at more than 16,000 petroleum outlets with 28,986 terminals in India.

Company’s History:

Company started providing banking automation solutions in India in 2004 and deployed products from international solution providers such as Diebold Nixdorf.

Company established its own country-wide service infrastructure and automation solutions expertise to provide related services.

In the year 2009, Company leveraged its banking automation solutions expertise and service reach to offer ATM outsourcing and managed services by, among other things, entering into two cooperation agreements with Diebold Nixdorf for banking and retail products.

As part of company’s strategy to strengthen the presence in the cash value chain, offer an integrated payments platform and improve our operational efficiencies, company commenced offering transaction switching services in 2011 and cash management services in 2012.

Company’s Business segments:

- Payment Solutions Business.

- Banking Automation Solutions Business.

- Other Automation Solutions (for customers in the retail, petroleum and colour sectors).

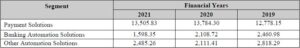

Revenue from various business segments: (in millions)

Payment Solutions Business:

Company’s Payment Solutions segment comprises ATM and CRM outsourcing and managed services, cash management services, iCDs, digital payment services which include toll and transit solutions, Fastlane, transaction switching services, services through POS machines and agency banking.

Company’s customers in the Payment Solutions segment include ICICI Bank Limited, Axis Bank Limited, HDFC Bank Limited and Federal Bank Limited.

As of March 31, 2021, company’s portfolio consisted of 13,959 ATMs and CRMs under our outsourcing business and 18,408 ATMs and CRMs under managed services business.

Banking Automation Solutions Business.

Banking Automation Solutions business segment, which commenced in 2004, comprises sale of ATMs and CRMs, currency technology products and self-service terminals and related services and upgrades.

As of March 31, 2021, company had approximately 50 banking customers, including ICICI Bank, HDFC Bank and Axis Bank.

Automation Solutions business.

This business segment encompasses the sale of machines and related services to customers in the retail, petroleum and colour segments.

Customers for retail sector offerings include More Retail Private Limited, while customers for our petroleum sector offerings include HPCL, IOCL and BPCL.

Company colour operations primarily comprise the supply of automatic paint dispensers and related services, and serve customers including Kansai Nerolac Paints and Berger Paints.

As of March 31, 2021, company has installed approximately 85,700 colour dispensing machines across India.

Cash Management Business:

The cash management services of company’s subsidiary, SVIL (Securevalue India Ltd), build on ATM outsourcing and managed services businesses, and include cash replenishment, cash pick-up, cash-in-transit (“CIT”), cash vaulting and cash processing services for ATMs.

As of March 31, 2021, company provided cash management services to 47,569 ATMs through a fleet of 2,425 cash vans including 232 dedicated cash vans to banks, and 474 vaults and spoke locations, covering approximately 1,860 cities and towns in India.

Company’s subsidiary, SVIL, was the second largest cash management company in India, in terms of revenue from cash management and number of ATMs replenished, as of March 31, 2021.

Largest deployer of POS terminals.

In a span of two years, company became one of the largest deployer of POS terminals at petroleum outlets in India.

In particular, company’s focus on serving the oil marketing industry, private and public sector banks and corporate merchants.

Of the 207,335 POS terminals deployed with clients as of March 31, 2021, 178,349 terminals were located at retail and corporate outlets and 28,986 terminals were located at OMCs.

International Expansion:

Company has also expanded internationally to offer automation and payment solutions to banks and financial institutions in other Asian countries comprising Sri Lanka, Singapore, Cambodia, Philippines and Indonesia.

For the financial years 2021 company derived 95.6%, revenues from operations in India.

Company’s Infrastructure Facilities:

Company has a 6,987.84 square metres facility at Daman, where we assemble, stage and conduct the testing of ATMs and other products.

Daman facility has the capacity to manufacture up to 1,000 ATMs every month. The facility also acts as a warehousing facility for our ATMs.

Company also has a central warehouse facility at Kalamboli, Maharashtra totalling 19,785 square feet.

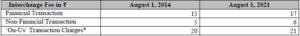

New Guidelines for Interchange Fee at ATMs in India.

In July 2021, the RBI allowed an increase in the interchange fee structure for ATM transactions after almost nine years, on account of the increasing cost of ATM deployment and expenses towards ATM maintenance incurred by the banks and white label ATM operators.

Management Team:

- Mr. Ravi B. Goyal (Designation: Chairman and Managing Director)

- Mrs. Anupama R. Goyal (Designation: Non-Independent, Non-Executive Director)

Objectives of the Issue:

Offer for Sale: (Rs.680 cr)

- Each of the Selling Shareholders will be entitled to the proceeds of the Offer for Sale. Company will not receive any proceeds from the Offer for Sale.

Positives for the Company:

Omni-Channel Integrated Payment and Cash Solutions Provider.

- Company is one of the largest integrated omni-channel payment solutions provider in India in terms of providing digital and cash-based solutions to banks and corporate clients, as of March 31, 2021.

- Company serves diverse industries such as banking, retail, petroleum, toll and transit, cash management and fintech in India and other select countries in Asia.

Diversified Product Portfolio, Customer Base and Revenue Streams Leading to Cross-Selling Opportunities.

- Company derives revenues from a variety of products and services catering to customers across diverse industries such as banking, retail, petroleum and colour. In each of these industries, company offers a combination of automation solutions along with payment and maintenance services.

Long-Standing Relationships with Technology Providers and Customers.

- Company has long-standing relationships with leading global technology providers, such as Diebold Nixdorf and ACI and have entered into a cooperation agreement with Diebold Nixdorf, under which company assemble ATMs in India.

Financials of the Company: (Consolidated)

| (in Crores) | FY 19 | FY 20 | FY 21 | 31st Aug 2021 |

|---|---|---|---|---|

| Revenue | 1823.6 | 1833.5 | 1797.1 | 762.3 |

| Net Profit | 66.1 | 83.0 | 54.7 | (-18.1) |

Valuation of Peer Group Companies:

| Company Name | Face Value | EPS | PE Ratio | RoNW | NAV |

|---|---|---|---|---|---|

| AGS Transact Technologies Ltd | 10 | 4.55 | 38.46 | 10.29% | 47.11 |

| CMS Info Systems Ltd | 10 | 11.09 | 27 | 17.12% | 66.52 |

IPO Details:

| Details | Info |

|---|---|

| Issue Opens on | 19th January 2022 |

| Issue Closes on:. | 21st January 2022 |

| Issue Price | Rs. 166 – 175 |

| Face Value | Rs. 10 |

| Retail Category Allocation | 35% |

| Minimum Lot | 85 shares |

| Minimum Investment | Rs. 14,875 |

| Issue Constitutes | 32.27% |

| Issue Size | Rs. 680 cr ($ 90 million) |

| Market Cap | Rs. 2106 cr ($ 280 million) |

| Listing at | NSE & BSE |

| Equity Shares Offered (OFS) | 3,88,57,143 (Rs. 680 cr) |

| Equity Shares Prior to the Issue | 12,03,92,576 |

| Equity Shares after the issue | 12,03,92,576 |

Also Read : List of Upcoming IPO’s in India. List of Upcoming SME IPO’s in India.

Important Dates:

| Finalization of Basis of Allotment | On or Before 27th January 2022 |

| Initiation of Refunds | On or Before 28th January 2022 |

| Credit of Equity Shares: | On or Before 31st January 2022 |

| Listing Date: | On or Before 1st February 2022 |

IPO Valuation Parameters:

| Earnings Per Share (EPS) | Price To Earnings ratio (PE) | Return on Net Worth (RoNW) | Net Asset Value (NAV) |

|---|---|---|---|

| 4.55 | 38.46 | 10.29% | 47.11 |

| Check IPO Allotment Status: |

|---|

Link InTime Website: https://linkintime.co.in/PublicIssue/BSE IPO Website: https://www.bseindia.com/IPO/Allotment |

| Company Contact Info: |

|---|

| AGS Transact Technologies Ltd 14th Floor, Tower 3, One International Center, Senapati Bapat Marg, Prabhadevi (West), Mumbai 400 013, Maharashtra, India; Tel: +91 22 7181 8181 Email: ipocompliance@agsindia.com; Website: www.agsindia.com |

| IPO Registrar Info: |

|---|

| Link Intime India Private Limited C-101, 1st Floor, 247 Park L.B.S. Marg, Vikhroli West Mumbai 400 083 Maharashtra, India Tel: +91 22 4918 6200 Email: ags.ipo@linkintime.co.in Website: www.linkintime.co.in |