About the Company:

Supriya Lifescience Ltd is one of the key Indian manufacturers and suppliers of active pharmaceuticals ingredients (“APIs”), with a focus on research and development.

Company has a niche product offerings of 38 APIs focused on diverse therapeutic segments such as antihistamine, analgesic, anaesthetic, vitamin, anti-asthmatic and antiallergic.

Company has consistently been the largest exporter of Chlorpheniramine Maleate and Ketamine Hydrochloride from India, contributing to 45-50% and 60-65%, respectively, of the API exports from India, between Fiscal 2017 and 2021.

Company is also among the largest exporters of Salbutamol Sulphate in India contributing to 31% of the API exports from India in FY 2021 in volume terms.

Company’s Customers:

Company’s customers include global pharma companies such as Syntec Do Brasil LTDA, American International Chemical Inc and AT Planejamento E Desenbolvimento De Negocios Ltda,Suan Farma Inc, Acme Generics LLP, Akum Drugs Ltd and Mankind Pharma Ltd.

Company’s Manufacturing Facilities:

Company’s business operations are supported by a modern manufacturing facility located in Parshuram Lote, Maharashtra, which is approximately 250 km from Mumbai, Maharashtra.

The manufacturing facility is spread across 23,806 sq.mts, having reactor capacity of 547 KL/ day and seven clean rooms.

In addition, Company has acquired a plot of land, admeasuring 12,551 sq.mt, near the present manufacturing facility, wherein the Company intends to expand its manufacturing infrastructure.

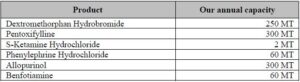

Company’s Annual Capacity:

Company’s Capacity Utilization:

Company’s Exports:

Company’s products are exported to 86 countries to 1,296 customers including 346 distributors.

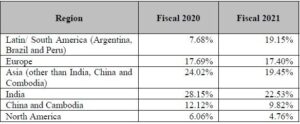

Company has grown the API business in several countries across Europe, which contributed to 17.40 %, Latin America, which contributed to 19.15 %, Asia (excluding India), which contributed to 29.27 % from operation for the year ended March 31, 2021.

Company’s Contribution in API Exports: (between Fiscal 2017 and 2021)

- Largest exporter of Chlorpheniramine Maleate and Ketamine Hydrochloride from India, contributing to 45-50% and 60-65%, respectively, of the API exports from

India. - Company contributed to 25-30% of exports of Vitamin B2 (Riboflavin, Lactoplavin) and its salts from India.

- Company contributes to around 2.50%-3% of pyridine derivatives export from India.

Region wise percentage of total revenue from operations:

Awards Received by the Company:

In 2019, Company was awarded the Outstanding Export Performance Award for the year 2018-19 for product group API / Bulk Drugs by Pharmaceuticals Export Promotion Council of India.

Competitors in the Business:

Company’s principal competitors include Divi’s Laboratories Ltd, Wanbury Limited, Unichem Laboratories Ltd, Mangalam Drugs and Organics Limited, IPCA laboratories Limited and Teva API B.V.

Management Team:

- Mr. Satish Waman Wagh (Designation: Chairman and Managing Director)

- Mrs. Smita Satish Wagh (Designation: Whole-time Director)

Objectives of the Issue:

Offer for Sale (Rs. 500 cr)

- Each of the Selling Shareholders will be entitled to the proceeds of the Offer for Sale. Company will not receive any proceeds from the Offer for Sale.

Fresh Issue (Rs. 200 cr)

- Funding capital expenditure requirements of the Company.

- Repayment and/ or pre-payment, in full or part, of certain borrowings availed by the Company.

- General corporate purposes.

Fund Utilization:

| Particulars | Amount (Rs. in Crores) |

|---|---|

| Funding capital expenditure requirements of the Company | 92.3 cr |

| Repayment and/or pre-payment, in full or part, of certain borrowings availed by the Company | 60.00 cr |

Positives for the Company:

Among the largest exporter of Salbutamol Sulphate from India.

- Company is among the largest exporter of Salbutamol Sulphate from India in Fiscal 2021 in term of volume.

- Company’s share in Salbutamol Sulphate exports have increased from 25-30% in Fiscal 2017 to 30-40% in Fiscal 2018 to Fiscal 2021.

- Salbutamol Sulphate, saw rise in demand in Fiscal 2021 on account of rise in demand for anti-asthmatic drugs.

- Exports of Salbutamol Sulphate from India saw a rise of 75-80% in Fiscal 2021, with major export destination being Singapore, USA, Thailand, China, Bangladesh, Germany and Indonesia.

Backward integrated business model.

- Company’s backward integration of API ensures steady supply of intermediates.

- As on October 31, 2021, 12 of the existing products are backward integrated, which contributed 67.14% of the total revenue for Fiscal year 2021, thereby resulting in increased margins and lesser dependence on suppliers for key starting material.

- Backward integration has enabled company to ensure a steady supply of intermediates at an equitable cost, avoiding any market fluctuations and to ensure quality and security of availability of essential raw materials.

- Company’s ability to produce key starting material is one the key strengths, resulting in cost competitiveness.

Geographically diversified revenues with a global presence across 86 countries.

- Company’s products are exported to 86 countries including regulated markets such as USA, China, Japan, Germany, Spain, Indonesia, South Korea and

Switzerland. - Products are also exported to semi-regulated and non-regulated markets such as Brazil, Mexico, Chile, Taiwan, Malaysia, Bangladesh, South Africa, Kenya, Jordan and Egypt, through our own marketing and distribution network as well as by entering into distribution arrangements with pharmaceutical distributors in these markets.

- For the Fiscals 2019, 2020, 2021 and for the six month period ended September 30, 2021, the export sales accounted for 70.96% 71.85%,77.47% and 73.57%, respectively of revenue from operations.

Expansion of manufacturing capabilities.

- Company presently operate from manufacturing facility located in Parshuram Lote, Maharashtra, spread across 23,806 sq.mts, having reactor capacity of 547 KL/ day.

- Company intends to enhance the production capacity and capabilities through additional capital expenditure in the existing manufacturing facilities.company has acquired a plot of land admeasuring 12,551 sq.mt near the present manufacturing facility.

Financials of the Company:

| (in Crores) | FY 19 | FY 20 | FY 21 | 30th Sept 2021 |

|---|---|---|---|---|

| Revenue | 285.8 | 322.7 | 396.2 | 230.0 |

| Net Profit | 39.4 | 73.4 | 123.8 | 65.9 |

Valuation of Peer Group Companies:

| Company Name | Face Value | EPS | PE Ratio | RoNW | NAV |

|---|---|---|---|---|---|

| Supriya Lifescience Ltd | 2 | 16.92 | 16.19 | 46.04% | 36.75 |

| Solara Active Pharma Sciences Ltd | 10 | 64.52 | 18.4 | 13.90% | 443.3 |

| Neuland Laboratories Ltd | 10 | 62.85 | 27.8 | 10.25% | 613.0 |

| Aarti Drugs Ltd | 10 | 30.09 | 16.8 | 30.70% | 98.0 |

| Divis Laboratories Ltd | 10 | 74.75 | 65.3 | 21.35% | 350.1 |

IPO Details:

| Details | Info |

|---|---|

| Issue Opens on | 16th December 2021 |

| Issue Closes on:. | 20th December 2021 |

| Issue Price | Rs.265 – 274 |

| Face Value | Rs.2 |

| Minimum Lot | 54 Shares |

| Minimum Investment | Rs.14,796 |

| Issue Constitutes | 31.74% |

| Issue Size | Rs.700 cr ($ 93 million) |

| Market Cap | Rs.2205 cr ($ 294 million) |

| Listing at | NSE & BSE |

| Equity Shares Offered (Fresh) | 72,99,270 (Rs.200 cr) |

| Equity Shares Offered (OFS) | 1,82,48,175 (Rs.500 cr) |

| Equity Shares Offered (Fresh + OFS) | 2,55,47,445 (Rs.700 cr) |

| Equity Shares Prior to the Issue | 7,31,83,530 |

| Equity Shares after the issue | 8,04,82,800 |

Also Read : List of Upcoming IPO’s in India.

Important Dates:

| Finalization of Basis of Allotment | on or Before 23rd December 2021 |

| Initiation of Refunds | on or Before 24th December 2021 |

| Credit of Equity Shares: | on or Before 27th December 2021 |

| Listing Date: | on or Before 28th December 2021 |

Subscription Details: (Will be Updated)

| (Subscription-Category-Wise (no. of times) Till time : 06:00 PM) | Shares Offered | Day-1 | Day-2 | Day-3 |

|---|---|---|---|---|

| QIB | 79,24,527 | 0.00 | 0.55 | 32.91 |

| NII | 39,62,263 | 0.67 | 2.94 | 166.69 |

| Retail | 26,41,509 | 12.05 | 26.05 | 57.70 |

| Employee | ———- | —– | —- | —– |

| TOTAL | 1,45,28,299 | 2.37 | 5.84 | 73.90 |

Note: Retail Subscription on the basis of Applications: 49.81x

IPO Valuation Parameters:

| Earnings Per Share (EPS) | Price To Earnings ratio (PE) | Return on Net Worth (RoNW) | Net Asset Value (NAV) |

|---|---|---|---|

| 16.92 | 16.19 | 46.04% | 36.75 |

| Check IPO Allotment Status: |

|---|

Link InTime Website: https://linkintime.co.in/PublicIssue/BSE IPO Website: https://www.bseindia.com/IPO/Allotment |

| Company Contact Info: |

|---|

| Supriya Lifescience Ltd 207/208, Udyog Bhavan, Sonawala Road, Goregaon (East), Mumbai – 400 063 Tel: +91 22 40332727 E-mail: cs@supriyalifescience.com Website: www.supriyalifescience.com |

| IPO Registrar Info: |

|---|

| Link Intime India Private Limited C-101, 247 Park, 1st Floor, L.B.S. Marg, Vikhroli West Mumbai 400 083 Maharashtra. India Tel: +91 22 4918 6200 E-mail: supriyalife.ipo@linkintime.co.in Website: www.linkintime.co.in |