About the Company:

Harsha Engineers International Ltd is the largest manufacturer of precision bearing cages, in terms of revenue, in organised sector in India, and amongst the

leading manufacturers of precision bearing cages in the world.

Company offers diversified suite of precision engineering products across geographies and end-user industries.

Company has approximately 50-60% of the market share in the organised segment of the Indian bearing cages market and 6.5% of the market share in the global organised bearing cages market for brass, steel and polyamide cages in CY 2021.

Company offers a wide range of bearing cages starting from 20 mm to 2,000 mm in diameter and our bearing cages find its application in the automotive, railways, aviation & aerospace, construction, mining, agriculture, electrical and electronics, renewables sectors etc.

Company, which housed a team of 253 qualified engineers (including solar EPC business) as of March 31, 2022, along with our decades of experience in bearing cages engineering, enable us to develop specialized products and solutions.

As of March 31, 2022, Company has been able to manufacture more than 7,205 bearing cages and more than 295 other products for customers in the automotive, railways, aviation & aerospace, construction, mining, agriculture, electrical and electronics, renewables sectors, allowing us to meet changing customer requirements.

In addition, over the past three years our product development and innovation centre has developed more than 1,200 products in different bearing types.

Products manufactured by the Company:

- Bearing Cages.

- Steel Cages.

- Brass Cages.

- Polyamide Cages.

Parent group Company:

Company is part of the Harsha Group which was established in 1986 and has over 35 years of operating history in the engineering business.

Harsha Engineering International Ltd, was incorporated in 2010 as Harsha Abakus Solar Private Ltd in order to consolidate the Harsha Group’s India engineering and solar EPC business, and to get the benefits of synergies,

Company’s business comprises:

(i) engineering business, under which we manufacture bearing cages (in brass, steel and polyamide materials), complex and specialised precision stamped components, welded assemblies and brass castings and cages & bronze bushings.

(ii) solar EPC business, under which we provide complete comprehensive turnkey solutions to all solar photovoltaic requirements.

Electrification of Vehicles:

While the automotive segment is shifting towards the electric vehicles, we believe its impact on harsha engineers will be limited as company is not manufacturing needle bearings cages which are engine components.

Needle cages bearing used in engines and small cage bearing used in two and three wheelers are likely to be the most impacted type of bearings due to increasing penetration of electric vehicles.

Further, we believe that the electrification of vehicles will increase the precision requirements sought by customers which will help companies like harsha engineers to further improve their market share in the sector.

Manufacturing of Bearing cage:

Bearing cage is an important component within a bearing and requires the highest lead time for development and technical and tooling expertise for its manufacture when compared to other components of a bearing.

Given the critical function of a bearing cage, and the resultant quality requirements, global bearing companies have steadily increased outsourcing for manufacturing of bearing cages and the business from these bearing companies has gotten concentrated to a few bearing cage manufacturers including Harsha Engineers Ltd.

Key Customers:

Company has established strong customer relationship with leading global bearing manufacturers in the automotive, railways, renewable energy and other industrial

sectors.

Additionally, company has been involved by key customer groups in their product development process from the design stage and accordingly, company has been able to ensure repeat orders from customers.

Each of our top five customer groups (excluding customers’ contributing to revenue from scrap sales) have been customers for over a decade.

Company’s Manufacturing facilities:

Company has four strategically located manufacturing facilities for engineering business with one of our principal manufacturing facilities at Changodar and one at Moraiya, near Ahmedabad in Gujarat in India, and one manufacturing unit each at Changshu, China and Ghimbav Brasov in Romania.

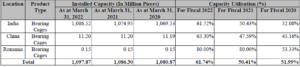

Company’s Installed Capacity and Capacity Utilization:

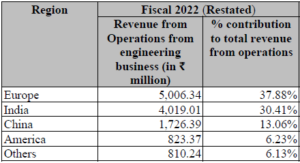

Revenue from International Business:

Company supply products to customers in over 25 countries covering five continents i.e., North America, Europe, Asia, South America and Africa.

To help company meet ‘just in time’ requirements of customers, company has entered into arrangements to stock inventory in warehouses spread across more than 20 locations across the world including in, Europe, US, China and South America.

Company’s multinational presence has also allowed company to diversify the revenue geographically.

Revenue break-up from various geographical regions:

Company’s Solar EPC business.

Company is also an EPC service provider in the solar photovoltaic industry and also provides operations and maintenance services in the solar sector.

Company has over 10 years of operating history in the solar EPC business.

Company has an in-house design, engineering, procurement, project management and O&M team which has a combined experience of installing at least 500 MW and more than 60 MW commissioning experience in roof top segment as of March 31, 2022.

Company’s revenue from solar EPC business aggregated to Rs.82.9 cr, Rs.54.1 cr, and Rs.64.1 cr for Fiscals 2022, 2021 and 2020, respectively, constituting 6.28%, 6.20%, and 7.25% respectively, of total revenue from operations.

Management Team:

- Mr. Rajendra Shah (Designation: Chairman and Whole-time Director)

- Mr. Harish Rangwala (Designation: Managing Director)

Objectives of the Issue:

Offer for Sale: (Rs.300 cr )

- Each of the Selling Shareholders will be entitled to the proceeds of the Offer for Sale. Company will not receive any proceeds from the Offer for Sale.

Fresh Issue: (Rs.455 cr)

- Pre-payment or scheduled repayment of a portion of the existing borrowing availed by the Company.

- Funding capital expenditure requirements towards purchase of machinery.

- Infrastructure repairs and renovation of our existing production facilities including office premises in India.

- General corporate purposes.

Positives for the Company:

Long standing relationships with leading clientele.

- Company has established strong relationship with customers who are leading global bearing manufacturers in the automotive, railways, aviation & aerospace, construction, mining, agriculture, electrical and electronics, renewables sectors.

- The bearing cages market globally is concentrated among a few global bearing manufacturers with top six global bearing manufacturers contributing to 54% of the market share in Fiscal 2022.

- As of March 31, 2022, company supplies to each of the top six global bearing manufacturers.

- Company’s multinational presence has also allowed company to diversify the revenue geographically and enhanced reputation which results in higher orders from India.

Strategically located domestic and international production facilities and warehouses.

- Company has four strategically located manufacturing facilities spread across three countries in India, China, and Romania.

- As on March 31, 2022, company’s aggregate installed capacity across these manufacturing facilities was 4,596 metric tonne per annum for castings and 1,097.87 million pieces per annum for bearing cages.

Plans to further expand into the Japanese bearing market.

- Company intend to further expand into the Japanese bearing market by suppling directly to the Japanese customers at their locations in Japan.

- In the past, company has been supplying to Japanese customers at their locations in India and to their locations outside of Japan.

- Company has recently started supplying products directly to their locations in Japan.

- Company believes that by supplying products directly to their locations in Japan, company will be able to better establish long standing relationship with Japanese customers, and thus expand further into the Japanese bearing market.

Increased focus on developing products suited to capture market opportunity in the growing electric vehicle segment.

- As the automobile segment is shifting focus to electric vehicles the need for more silent and lighter bearings, and it’s components, will be felt, and the demand is likely to increasingly shift towards precise dimension and dirt free bearing, steel and polyamide cages as a probable solution at a premium value.

- Company believes that company’s inhouse tool and design facilities coupled with latest machinery, specialised cleaning equipment and software would enable company to manufacture precision stamping components and steel cages suited for the electric vehicle segment.

Financials of the Company:

| (in Crores) | FY 20 | FY 21 | FY 22 |

|---|---|---|---|

| Revenue | 899.5 | 876.7 | 1338.9 |

| Net Profit | 21.9 | 45.4 | 91.9 |

Valuation of Peer Group Companies:

| Company Name | Face Value | EPS | PE Ratio | RoNW | NAV |

|---|---|---|---|---|---|

| Harsha Engineers International Ltd |

10 | 11.09 | 29.75 | 17.42% | 68.34 |

| Rolex Rings Limited | 10 | 50.23 | 36.04 | 24.21% | 200 |

IPO Details:

| Details | Info |

|---|---|

| Issue Opens on | 14th September 2022 |

| Issue Closes on:. | 16th September 2022 |

| Issue Price | Rs.314 – 330 |

| Face Value | Rs.10 |

| Retail Category Allocation | 35% |

| Minimum Lot | 45 Shares |

| Minimum Investment | Rs.14,850 |

| Issue Constitutes | 25% |

| Issue Size | Rs.755 cr ($93 million) |

| Market Cap | Rs.3000 cr ($375 million) |

| Listing at | NSE & BSE |

| Equity Shares Offered (Fresh) | 1,36,36,363 |

| Equity Shares Offered (OFS) | 90,90,910 |

| Total Equity Shares Offered (Fresh + OFS) | 2,27,27,273 |

| Equity Shares Prior to the Issue | 7,72,48,410 |

| Equity Shares after the issue | 9,08,84,773 |

Also Read : List of Upcoming IPO’s in India.

Also Read : List of Upcoming SME IPO’s in India.

IPO Valuation Parameters:

| Earnings Per Share (EPS) | Price To Earnings ratio (PE) | Return on Net Worth (RoNW) | Net Asset Value (NAV) |

|---|---|---|---|

| 11.09 | 29.75 | 17.42% | 68.34 |

| Check IPO Allotment Status: |

|---|

Link InTime Website: https://linkintime.co.in/PublicIssue/BSE IPO Website: https://www.bseindia.com/IPO/Allotment |

| Company Contact Info: |

|---|

| Harsha Engineers International Ltd Harsha Abakus Solar Private Limited) NH-8A, Sarkhej-Bavla Highway, Changodar, Ahmedabad 382213, Gujarat, India Telephone: + (91) 2717-618200 Website: www.harshaengineers.com |

| IPO Registrar Info: |

|---|

| Link Intime India Private Limited C-101, 247 Park, L.B.S. Marg, Vikhroli (West), Mumbai 400 083, Maharashtra, India Telephone: +(91) 22 4918 6200 E-mail: harshaengineers.ipo@linkintime.co.in Investor Grievance E-mail: harshaengineers.ipo@linkintime.co.in Website: www.linkintime.co.in |