About the Company:

About the Company:

Sona Machinery Ltd is a diversified agro-processing equipment manufacturer, manufacturing equipments for the processing of rice, pulses, wheat, spices, Barnyard Millet etc.

Company’s product portfolio includes Grains Pre-Cleaner machines, Rotary Drum Cleaner, Vibro Classifiers, Stone Separator Machines, Paddy De-Husker, Husk Aspirator, Rice Thick/Thin Grader, Rice Whitener, Silky Polisher, Multi Grader, Length Grader, Belt Conveyer, Bucket Elevator etc. along with the complete projects for rice mills and ethanol distilleries.

Company’s services encompass engineering, erection, supervision, and machine commissioning, delivering a comprehensive end-to-end solution for the milling section which includes grain unloading and milling solution upto pre-masher for ethanol distilleries and paddy unloading to rice packaging for rice mill industries.

Company’s product portfolio comprises of various equipments including support services for all the equipments manufactured and supplied by the company.

Company is manufacturing and supplying agro-processing equipments under various categories like cleaning, grading, blending, material handling etc.

Currently company has a manufacturing unit situated at Ghaziabad, Uttar-Pradesh with a total area of approx. 52,205 sq. ft. and a warehouse for storage of our material and finished goods.

Company’s manufacturing facility is equipped with requisite infrastructure including machineries and other handling equipment to facilitate smooth manufacturing process.

Company has also exported small portion of its products to the countries like Nigeria, Bangladesh, Kenya, Nepal etc. and generated around 3.12% of our total revenue from export sales for the period ending fiscal year ending 2023.

Company’s Product Portfolio:

- Complete Project for Rice Mills and Ethanol Distilleries.

- Support Machines for Rice Mills and Grain Based Distilleries.

Awards and Accreditations:

- ISO 9001:2015 for Quality Management Systems by Das System & Services Pvt Ltd.

- Top 10 Industrial Service Provider 2022 by Industry Outlook.

- Prestigious Brands Asia 2022 by Barc Asia.

- Prestigious Brands Asia 2023 by Barc Asia.

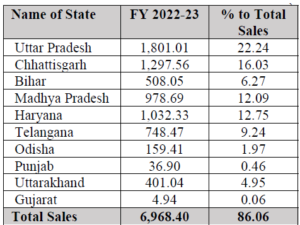

Company’s Revenue from top ten geographies in India is as follows: (in Lakhs)

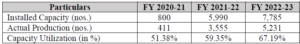

Company’s Installed Capacity & Capacity Utilization:

Management Team:

- Mr. Vasu Naren (Designation: Chairman & Managing Director)

- Ms. Shweta Baisla (Designation: Wholetime Director & CFO)

Competitiors in the Business:

- Company faces competition from organized and unorganized players in the agro-processing equipment industry which have a presence across multiple regions in India.

- There are various companies offering products and services similar to Sona Machinery Ltd.

- Company believes that the principal elements of competition in our industry are price, durability, product quality, timely delivery, after sale services, reliability and most importantly our pace in keeping up with the changing technology in the industry.

- To stay competitive, company regularly updates the existing facilities/technology and adopt new technology for the manufacturing facilities. Company aims to keep the costs of production low to maintain competitive advantage.

- Sona Machinery Ltd have no listed companies comparable , however, Suri Engineers Private Limited; Milltec Machinery Private Limited could be considered as comparable to the company.

Objectives of the Issue:

Fresh Issue: (Rs.51.82 cr)

- Funding the Capital Expenditure requirements of our company towards setting up of a new manufacturing unit at Ghaziabad.

- Repayment of the outstanding amount of the Letter of Credit availed by our company for purchase of machinery.

- General Corporate Purpose.

Fund Utilisation:

| Particulars | Amount (Rs. in Crores) |

|---|---|

| Funding the Capital Expenditure requirements of our company towards setting up of a new manufacturing unit at Ghaziabad. |

28.91 cr |

| Repayment of the outstanding amount of the Letter of Credit availed by our company for purchase of machinery |

2.00 cr |

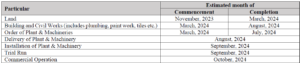

Proposed Schedule of Implementation for setting up of a new manufacturing unit is as follows:

Peer Group Comparison:

There are no listed companies in India that are engaged in the business line similar to that of Sona Machinery Ltd , thus it is not possible to provide an industry comparison in relation to the company.

Positives for the Company:

Diversified product range appealing to a wide range of customers.

- Company has diverse product portfolio across various categories which includes equipments for material handling, cleaning, blending, grading etc. for processing of various grains.

- Company deals in a wide range of products, which enables us to cater widespread customer base across India and also expand our reach in international locations.

- Over the period, company has expanded the focus from the manufacture of equipment exclusively for the facilitation of rice processing equipment, to take into consideration various other grains including pulses, maize and wheat.

- Company has necessary resources, experience and network to launch additional products in future that can be customized and leveraged to cater to wider range of agro-processing equipments as per requirements of the customers.

Diversified revenue from multiple geographies.

- Company has diversified revenue from multiple geographical locations across India and from places outside India including Nigeria, Bangladesh, Kenya, Nepal and generated around 3.12% of total revenue from export sales.

- Company has expanded geographical outreach across India, and have the ability to quickly respond to changing consumer preferences and constantly fluctuating demand.

- Company’s presence in multiple geographies not only helps in expanding the client base but also helps to mitigate risk for any unforeseen circumstances in the domestic market and expand our business operations.

Company plans to expand domestic and international presence.

- Currently around 98.87% of the revenue is from domestic markets and 1.13% is from international markets.

- Company further seeks to identify markets where we believe we can provide cost advantages to our clients and distinguish ourselves from other competitors.

- Going forward, company would like to continue to expand the domestic and international presence to enhance company’s visibility.

Company plans to setup of new integrated manufacturing facility.

- Company is currently in process of setting up an additional manufacturing unit in Ghaziabad, Uttar Pradesh, in order to increase our manufacturing capabilities through manufacturing existing and new products like Hammer mill, pulverizer, Paddy Driers etc.

- The Proposed land on which the said unit is being constructed comprises of over 90,729 sq. ft. area. The total cost for setting up new manufacturing unit is estimated to be Rs.30.41 cr.

- The plant & machinery at the facility under expansion is targeted to be more automated to reduce human intervention and thus decreasing the scope of human error.Company believes that the entire activity will lead to higher efficiency and production output.

Financials of the Company:

| (in Crores) | FY 21 | FY 22 | FY 23 | Upto 30th Nov 23 |

|---|---|---|---|---|

| Revenue | 6.06 | 44.53 | 81.18 | 62.88 |

| Net Profit | 0.27 | 3.26 | 7.68 | 6.47 |

IPO Details:

| Details | Info |

|---|---|

| Issue Opens on | 5th March 2024 |

| Issue Closes on | 7th March 2024 |

| Issue Price | Rs.136 – 143 |

| Face Value | Rs.10 |

| Minimum Lot | 1000 Shares |

| Minimum Investment | Rs.1,43,000 |

| Issue Constitutes | 26.40 % |

| Issue Size | Rs.51.82 cr |

| Market Cap | Rs.196.25 cr |

| Listing at | NSE SME |

| Equity Shares Offered (Fresh) | 36,24,000 (Rs.51.82 cr) |

| Equity Shares Prior to the Issue | 1,01,00,000 |

| Equity Shares after the Issue | 1,37,24,000 |

Also Read : List of Upcoming IPO’s in India.

Also Read: List of Upcoming SME IPO’s in India.

Important Dates:

| Finalization of Basis of Allotment | on or Before 11th March 2024 |

| Initiation of Refunds | on or Before 12th March 2024 |

| Credit of Equity Shares: | on or Before 12th March 2024 |

| Listing Date: | on or Before 13th March 2024 |

IPO Valuation Parameters:

| Earnings Per Share (EPS) | Price To Earnings ratio (PE) | Return on Net Worth (RoNW) | Net Asset Value (NAV) |

|---|---|---|---|

| 7.61 | 18.79 | 67.86% | 11.21 |

| Company Contact Info: |

|---|

| Sona Machinery Limited Unit No. 701, 7th floor, KLJ Tower, Plot No. B-5, Netaji Subhash Place, Maurya Enclave, North West Delhi, Delhi – 110034, India. Email: finance@sonamachinery.com Website: www.sonamachinery.com |

| Registrar to the Issue: |

|---|

| MAASHITLA SECURITIES PRIVATE LIMITED 451, Krishna Apra Business Square, Netaji Subhash Place, Pitampura, New Delhi, 110034, India. Tel No: +91-11-45121795 Email: ipo@maashitla.com Website: www.maashitla.com |

| Lead Manager to the Issue: |

|---|

| HEM SECURITIES LIMITED 904, A Wing, Naman Midtown, Senapati Bapat Marg, Elphinstone Road, Lower Parel, Mumbai-400013, Maharashtra, India Tel. No.: +91- 22- 49060000; Email: ib@hemsecurities.com Website: www.hemsecurities.com |