About the Company:

Shyam Metalics and Energy Ltd is a leading integrated metal producing company based in India with a focus on long steel products and ferro alloys.

Company is amongst the largest producers of ferro alloys in terms of installed capacity in India, as of February 2021

Company is one of the leading players in terms of pellet capacity and the fourth largest player in the sponge iron industry in terms of sponge iron capacity in India.

Company is also one of the leading integrated steel and ferro alloys producers in the eastern region of India in terms of long steel products.

Company’s Employee Strength:

- As of December 31, 2020, company had a workforce of 11,457 personnel comprised 5,841 permanent employees and 5,616 contract employees for our operations.

Company’s products:

Shyam Metalics primarily produce intermediate and long steel products, such as, iron pellets, sponge iron, steel billets, TMT, structural products, wire rods, and ferro alloys products with a specific focus on high margin products, such as, customised billets and specialised ferro alloys for special steel applications.

Company’s TMT and structural products are sold under the brand ‘SEL’.

Company’s Major Customers:

- Jindal Stainless Ltd

- Jindal Stainless (Hisar) Ltd

- Rimjhim Ispat Ltd

- POSCO International Corporation,

- World Metals & Alloys (FZC)

- Traxys North America LLC

- JM Global Resources Ltd

- Goenka Steels Private Ltd

Company’s Distribution Network:

As of December 31, 2020, company had partnerships with 42 distributors, who stock and sell our finished products across 13 states and one union territory.

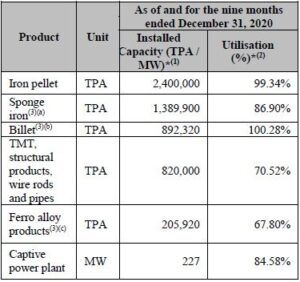

Company’s Installed Capacity & Capacity Utilization:

Company’s revenue mix from various products:

| Product Name | As a % of total revenue from sale of manufactured products |

Revenue from sale (in cr) |

|---|---|---|

| Ferro alloys | 15.47% | 5,99.5 |

| TMT, structural products, wire rods and pipes | 37.39% | 1449.5 |

| Steel billets | 13.97% | 541.7 |

| Sponge iron | 11.35% | 440.2 |

| Iron pellets | 21.81% | 845.6 |

| Total | 100% | Rs.3876.8 cr |

Company’s Capacity Expansion:

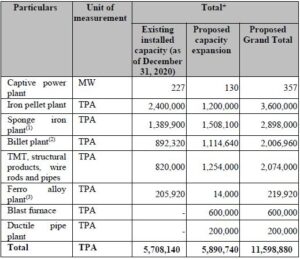

- Company is in the process of increasing the capacities of our existing manufacturing plants and captive power plants, which is expected to increase our aggregate installed metal capacity from 5.71 MTPA, as of December 31, 2020, to 11.60 MTPA and captive power plants aggregate installed capacity from 227 MW, as of December 31, 2020, to 357 MW.

- These proposed expansions are expected to become operational between Fiscal 2022 and Fiscal 2025.

- In addition, Company is also in the process of commissioning an aluminium foil rolling mill at Pakuria in West Bengal with a proposed installed capacity of 0.04 MTPA, which is expected to become operational in Fiscal 2022.

Competitors for the Company:

Company operates and sells its products in highly competitive markets. The market for company’s intermediate and final products is highly competitive.

company’s primary competitors include Jindal Steel and Power Ltd, Tata Steel Ltd, Steel Authority of India Ltd, JSW Steel Ltd, Kalyani Steel Ltd and Prakash Industries.

Company’s Manufacturing Facilities:

Company currently operates three manufacturing plants that are located at Sambalpur in Odisha, and Jamuria and Mangalpur in West Bengal.

As of December 31, 2020, the aggregate installed metal capacity of our manufacturing plants was 5.71 million tonne per annum (“MTPA”) (comprising of intermediate and final products).

Company’s manufacturing plants also include captive power plants with an aggregate installed capacity of 227 MW, as of December 31, 2020.

Company’s Existing, proposed and Grand proposed Capacity:

Management Team:

- Mr. Mahabir Prasad Agarwal (Designation: Chairman)

- Mr. Brij Bhushan Agarwal (Designation: Vice Chairman and Managing Director)

Positives for the Company:

Least leveraged company among its peers.

- Company is also the least leveraged group among its peers. As of March 31, 2018, 2019 and 2020 and as of December 31, 2020, our Gross Debt to Equity ratio was 0.30, 0.29, 0.47 and 0.27, respectively.

- Company’s RoCE for Fiscals 2018, 2019 and 2020 and for the nine months ended December 31, 2020 was 19.58%, 24.69%, 9.49% and 13.30%, respectively.

Integrated operations across the steel value chain.

- Company is a leading integrated metal producing company based in India and one of the leading integrated steel and ferro alloys producers in the eastern region of India in terms of long steel products.

Company benefits from Captive Power Plants.

- In Fiscals 2018, 2019 and 2020, and the nine months ended December 31, 2020, the Average cost of Power from Captive Power Plants was Rs.2.24 per kwh, Rs.2.16 per kwh, Rs. 2.09 per kwh and Rs.2.49 per kwh, respectively, which we believe is relatively lesser than the power procured by us from external sources.

- In addition, company’s relatively high capacity utilization has led to lower fixed cost per tonne resulting in an increase in our profitability.

Company continues to increase manufacturing capacities.

- Company intends to strengthen the leading market position in India and achieve better economies of scale by expanding our existing manufacturing capacities and setting up additional manufacturing plants. Company has, over the years, consistently grown the manufacturing capabilities.

Company plans to Introduce new products by leveraging the forward integration capabilities.

- Company is in the process of (i) setting up a new 200,000 TPA ductile iron pipe plant at our Jamuria manufacturing plant; and (ii) commissioning an aluminium foil rolling mill at Pakuria in West Bengal by installing two mills with an installed capacity of 20,000 TPA each.

- Company expects this aluminium foil rolling mill to become operational in Fiscal 2022.

Company plans to increase the Export business.

- Currently export the products to Nepal, China, Bangladesh, Bhutan, United Kingdom, South Korea, Thailand, Indonesia, Taiwan and Japan, and are currently exploring newer geographies in North America, South America, Europe and Africa in order to increase the exports.

- Company’s revenue from exports amounted to Rs.4,21.1 crores and Rs.4,40.2 croresin Fiscal 2020 and the nine months ended December 31, 2020, respectively.

Strategically located manufacturing plants supported by robust infrastructure resulting in cost and time efficiencies.

- Company’s manufacturing facilities are strategically located in close proximity to our raw material sources, which we believe lowers the transportation costs and provides significant logistics management and cost benefits thereby improving operating margins.

- Company’s manufacturing plants are located within 250 kilometres of the mineral belt in eastern India, including, iron ore, iron ore fines, manganese ore, chrome ore and coal mines, our primary raw materials.

- The strategic location of manufacturing plants has enabled company to export the products to international customers in a cost efficient manner.

Objectives of the Issue:

Offer for Sale: (Rs. 252cr)

- The proceeds of the Offer for Sale shall be received by the Selling Shareholders. Company will not receive any proceeds from the Offer for Sale and the proceeds received from the Offer.

Fresh Issue: (Rs.657 cr)

- Repayment and/or pre-payment, in full or part, of debt of our Company and SSPL, one of our Subsidiaries.

- General corporate purposes.

Financials of the Company:

| (in Crores) | FY 17 | FY 18 | FY 19 | FY 20 | 31st Dec 21 |

|---|---|---|---|---|---|

| Revenue | 2480.7 | 3928.1 | 4684.5 | 4395.3 | 3995.6 |

| Net Profit | 81.3 | 529.55 | 636.7 | 340.3 | 456.3 |

Valuation of Peer Group Companies:

| Company Name | Face Value | EPS | PE Ratio | RoNW | NAV |

|---|---|---|---|---|---|

| Shyam Metalics and Energy Ltd | 10 | 14.57 | 21.0 | 12.04% | 120.97 |

| JSW Steel Ltd | 1 | 25.71 | 12.14 | 22.05% | 113.91 |

| Tata Steel Ltd | 10 | 128.10 | 4.44 | 28.74% | 513.30 |

| Jindal Steel & Power Ltd | 1 | (15.38) | NA | (5.27%) | 318.46 |

| Tata Sponge Iron Ltd | 10 | 91.48 | 10.75 | 14.28% | 640.60 |

IPO Details:

| Details | Info |

|---|---|

| Issue Opens on | 14th June 2021 |

| Issue Closes on:. | 16th June 2021 |

| Issue Price | Rs.303 – 306 |

| Face Value | Rs.10 |

| Minimum Lot | 45 shares |

| Minimum Investment | Rs.13770 |

| Retail category Allocation | 35% |

| Issue Constitutes | 11.64% |

| Issue Size | Rs.909 cr ($122 million) |

| Market Cap | Rs.7805 cr ($1.05 billion) |

| Listing at | NSE & BSE |

| Equity Shares Offered (Fresh) | 2,14,70,588 |

| Equity Shares Offered (OFS) | 82,35,295 |

| Total Equity Shares Offered (Fresh + OFS) | 2,97,05,883 |

| Equity Shares Prior to the Issue | 23,36,10,100 |

| Equity Shares after the Issue | 25,50,80,688 |

Important Dates:

| Finalization of Basis of Allotment | On or before 21st June 2021 |

| Initiation of Refunds | On or before 22nd June 2021 |

| Credit of Equity Shares: | On or before 23rd June 2021 |

| Listing Date: | On or before 24th June 2021 |

Subscription Details: (Will be Updated)

| (Subscription-Category-Wise (no. of times) Till time : 06:00 PM) | Shares Offered | 14/06 | 15/06 | 16/06 |

|---|---|---|---|---|

| QIB | 59,40,889 | 0.00 | 0.81 | 155.71 |

| NII | 44,55,000 | 0.70 | 2.60 | 339.98 |

| Retail | 1,03,95,001 | 2.19 | 5.80 | 11.64 |

| Employee | 3,00,000 | 0.27 | 0.78 | 1.55 |

| TOTAL | 2,10,90,890 | 1.23 | 3.65 | 121.43 |

IPO Valuation Parameters:

| Earnings Per Share (EPS) | Price To Earnings ratio (PE) | Return on Net Worth (RoNW) | Net Asset Value (NAV) |

|---|---|---|---|

| 18.23 | 21.00 | 22.95% | 79.43 |

| Check IPO Allotment Status: |

|---|

KfinTech Website : http://kfintech/IPO/Allotment_StatusBSE IPO Website: https://www.bseindia.com/IPO/Allotment |

Also Read:

| Sona Comstar Ltd | Dodla Dairy Ltd |

| KIMS Hospitals | Devyani International Ltd |

| Company Contact Info: |

|---|

| Shyam Metalics and Energy Ltd Trinity Tower, 7th Floor 83, Topsia Road, Kolkata – 700046 West Bengal Tel: +91 33 4016 4000 Fax: +91 33 4016 4025 E-mail: compliance@shyamgroup.com Website: www.shyammetalics.com |