About the Company:

RateGain Travel Technologies Ltd is among the leading distribution technology companies globally and are the largest Software as a Service (“SaaS”) company in the hospitality and travel industry in India.

Company offers travel and hospitality solutions across a wide spectrum of verticals including hotels, airlines, online travel agents (“OTAs”), meta-search companies,

vacation rentals, package providers, car rentals, rail, travel management companies, cruises and ferries.

Company is one of the largest aggregators of data points in the world for the hospitality and travel industry.

In the hotel segment, company work primarily with large and mid-size chains including the InterContinental Hotels Group, Kessler Collection, a luxury hotel chain, Lemon Tree Hotels Limited and Oyo Hotels

Company’s History:

Company began operations in 2004 with the introduction of a competitive intelligence price comparison product for hotels.

Over the last 15 years, company has expanded the product portfolio to include artificial intelligence and machine learning capabilities that leverage our in-house data lake to offer products in the areas of rate intelligence, cognitive revenue management, smart distribution and brand engagement.

Hospitality and Travel Technology Solutions:

Company delivers hospitality and travel technology solutions through SaaS platform and the products are classified into three strategic business units:

Data as a Service (“DaaS”):

Delivers insights including competitive intelligence and able to equip suppliers and demand providers with the ability to connect with data and information to increase acquisition and conversion.

Geography wise Revenue from Customers:

Distribution:

Company provides mission critical distribution including availability, rates, inventory and content connectivity between leading accommodation providers and their demand partners.

Marketing Technology (“MarTech”):

MarTech offering enhances brand experience to drive guest satisfaction, increase bookings and increases guest loyalty.

Company also manage social media for luxury travel suppliers allowing them to be responsive to social media engagements 24×7 as well as effectively manage their social media handles and run promotional campaigns.

Company’s Customers:

Company serves 1,462 customers including eight Global Fortune 500 companies. Company’s customers include Six Continents Hotels, Inc., an InterContinental Hotels Group Company, Kessler Collection, a luxury hotel chain, Lemon Tree Hotels Limited and Oyo Hotels and Homes Private Limited.

Company also count 1,220 large and mid-size hotel chains, 110 travel partners including airlines, car rental companies and large cruise companies and over 132 distribution partners including OTAs such as GroupOn and distribution companies such as Sabre GLBL Inc., in over 110 countries as company’s customers.

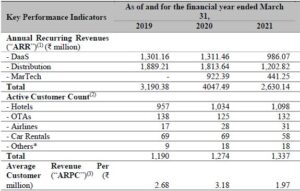

Key performance indicators for our business operations:

Management Team:

- Mr. Bhanu Chopra (Designation: Chairman and Managing Director)

- Mrs. Megha Chopra (Designation: Executive Director)

Objectives of the Issue:

Offer for Sale (OFS): (Rs.960 cr)

- Company will not receive any proceeds from the Offer. All proceeds from the Offer will go to the Selling Shareholders.

Fresh Issue: (Rs.375 cr)

- Repayment/prepayment of indebtedness availed by RateGain UK, one of our Subsidiaries, from Silicon Valley Bank.

- Payment of deferred consideration for acquisition of DHISCO.

- Strategic investments, acquisitions and inorganic growth.

- Investment in technology innovation, artificial intelligence and other organic growth initiatives.

- Purchase of certain capital equipment for our Data Center.

- General corporate purposes.

Peer Group Comparison:

There are no listed companies in India that engage in a business similar to that of our Company. Accordingly, it is not possible to provide an industry comparison in relation to RateGain Travel Technologies.

Positives for the Company:

Marquee global customers with long-term relationships.

- Company has a global and diverse customer base with long-standing relationships.

- As of September 30, 2021, company has a customer base of 1,462 customers including eight Global Fortune 500 companies comprised both travel suppliers and travel intermediaries including airlines, hotels, cruise lines, car rental companies, online travel agents, tour operators and wholesalers.

- Company’s customers include 25 out of the top 30 OTAs, several of the world’s fastest-growing airlines, 23 of the top 30 hotel chains, tour operators and wholesalers, all leading car rental companies, all large cruise lines, and the largest travel management companies.

Financials of the Company:

| (in Crores) | FY 19 | FY 20 | FY 21 | 31st August 21 |

|---|---|---|---|---|

| Revenue | 272.7 | 457.6 | 264.0 | 131.2 |

| Net Profit | 11.0 | (-20.1) | (-28.5) | (-8.3) |

IPO Details:

| Details | Info |

|---|---|

| Issue Opens on | 7th December 2021 |

| Issue Closes on:. | 9th December 2021 |

| Issue Price | Rs.405 – 425 |

| Face Value | Rs.1 |

| Retail Category Allocation | 10% |

| Minimum Lot | 35 Shares |

| Minimum Investment | Rs.14,875 |

| Issue Constitutes | 32.09% |

| Issue Size | Rs.1335 cr ($ 178 million) |

| Market Cap | Rs.4536 cr ($ 604 million) |

| Listing at | NSE & BSE |

| Equity Shares Offered (Fresh) | 88,23,530 (Rs.375 cr) |

| Equity Shares Offered (OFS) | 2,26,05,530 (Rs.960 cr) |

| Total Equity Shares Offered (Fresh + OFS) | 3,14,29,060 (Rs. 1335 cr) |

| Equity Shares Prior to the Issue | 9,79,22,360 |

| Equity Shares after the issue | 10,67,45,890 |

Also Read : List of Upcoming IPO’s in India.

Important Dates:

| Finalization of Basis of Allotment | on or Before 14th December 2021 |

| Initiation of Refunds | on or Before 15th December 2021 |

| Credit of Equity Shares: | on or Before 16th December 2021 |

| Listing Date: | on or Before 17th December 2021 |

Subscription Details:

| (Subscription-Category-Wise (no. of times) Till time : 06:00 PM) | Shares Offered | Day-1 | Day-2 | Day-3 |

|---|---|---|---|---|

| QIB | 93,93,424 | 0.00 | 0.00 | 8.42 |

| NII | 46,96,711 | 0.04 | 0.08 | 42.04 |

| Retail | 31,31,141 | 2.21 | 3.94 | 8.06 |

| Employee | 1,29,870 | 0.34 | 0.72 | 1.37 |

| TOTAL | 1,73,51,146 | 0.41 | 0.74 | 17.40 |

Note: Retail Subscription on the basis of Applications: 7.42x

IPO Valuation Parameters:

| Earnings Per Share (EPS) | Price To Earnings ratio (PE) | Return on Net Worth (RoNW) | Net Asset Value (NAV) |

|---|---|---|---|

| (-3.09) | N.A | (-11.67%) | 26.49 |

| Check IPO Allotment Status: |

|---|

KfinTech Website: http://kfintech/IPO/Allotment_StatusBSE IPO Website: https://www.bseindia.com/IPO/Allotment |

| Company Contact Info: |

|---|

| RateGain Travel Technologies Limited 4th and 5th Floor Prius Global Plot No. A- 3,4,5, Sector 125 Noida 201 301 Uttar Pradesh, India. Tel: +91 120 5057 000; E-mail: compliance@rategain.com Website: www.rategain.com |

| IPO Registrar Info: |

|---|

| KFin Technologies Private Limited Selenium, Tower B, Plot No – 31 and 32 Financial District, Nanakramguda, Serilingampally Hyderabad, Rangareedi 500 032 Telangana, India Tel: + 91 40 6716 2222 E-mail: rategain.ipo@kfintech.com Website: www.kfintech.com |