About the Company:

Krishna Institute of Medical Sciences Ltd is one of the largest corporate healthcare groups in AP and Telangana in terms of number of patients treated and treatments offered.

Company provides multi-disciplinary integrated healthcare services, with a focus on primary secondary & tertiary care in Tier 2-3 cities and primary, secondary, tertiary and quaternary healthcare in Tier 1 cities.

Company operate 9 multi-specialty hospitals under the “KIMS Hospitals” brand, with an aggregate bed capacity of 3,064, including over 2,500 operational beds as of December 31, 2020.

Company offers a comprehensive range of healthcare services across over 25 specialties and super specialties, including cardiac sciences, oncology, neurosciences, gastric sciences, orthopaedics, organ transplantation, renal sciences and mother & child care.

Company’s History:

KIMS Hospital have grown from a single hospital to a chain of multi-specialty hospitals through organic growth and strategic acquisitions under the leadership of Dr. Bhaskara Rao Bollineni, company’s founder and Managing Director, and Dr. Abhinay Bollineni, our Executive Director and CEO.

Company’s first hospital was established in Nellore in 2000 and has a capacity of approximately 200 beds.

Company’s flagship hospital at Secunderabad is one of the largest private hospitals in India at a single location (excluding medical colleges), with a capacity of 1,000 beds.

Company’s Structure:

Company’s Past Expansion:

KIMS Hospital have significantly expanded the hospital network in recent years through acquisitions of hospitals in Ongole in Fiscal Year 2017, Vizag and Anantapur in Fiscal Year 2019 and Kurnool in Fiscal Year 2020.

Approximately one-third of hospital 3,064 beds were launched in the last four years and have added over 880 beds, in aggregate, in our hospitals in Visakhapatnam (Vizag), Anantapur and Kurnool in Fiscal Years 2019 and 2020, and improved the overall bed occupancy rate in these hospitals from 71.83% to 80.49% in the same period.

Over a period of time company has expanded into nine cities across AP and Telangana through a combination of greenfield, brownfield and acquisition-led expansion.

Company’s Network of Hospitals:

Company’s current network consists of hospitals strategically located to serve the healthcare needs of AP and Telangana across urban Tier 1 cities such as Secunderabad and Hyderabad and more rural Tier 2-3 areas such as Vizag, Nellore, Rajahmundry, Srikakulam, Ongole, Anantapur and Kurnool.

Company’s hospitals are also situated well to capture patient in-flow across AP and Telangana and from the neighboring states of Karnataka, Odisha, Tamil Nadu and parts of central India.

Company’s ARPOB & ALOS:

In Fiscal Year 2020, company’s nine hospitals recorded ARPOB (Average Revenue Per Operating Bed ) of Rs.18,307, a bed occupancy rate of 80.49%, and an ALOS (Average of length of stay) of 4.34 days, on an aggregate basis.

In Fiscal Year 2020, ARPOB for company’s hospitals situated in Tier 1 cities was Rs.27,410 and ARPOB for hospitals situated in Tier 2-3 cities was Rs.11,758.

Company’s Operational metrics:

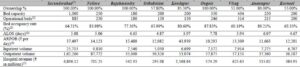

Hospital wise Key Financial and Operational Metrics:

Management Team:

- Dr. Bhaskara Rao Bollineni (Designation: Managing Director)

- Dr. Abhinay Bollineni (Designation: Executive Director and CEO)

Objectives of the Issue:

Offer for Sale: (Rs. 1943 cr)

- Company will not receive any proceeds of the Offer for Sale by the Selling Shareholders. Each of the Selling Shareholders will be entitled to the respective proportion of the proceeds of the Offer for Sale.

Fresh Issue: (Rs. 200 cr)

- Repayment/pre-payment, in full or part, of certain borrowings availed by the Company and by our Subsidiaries viz KHKPL, SIMSPL and KHEPL.

- General corporate purposes.

Positives for the Company:

Company is one of the largest corporate healthcare groups in AP and Telangana.

- KIMS Hospital is one of the largest corporate healthcare groups in AP and Telangana in terms of number of patients treated and treatments offered.

- Company has 3,064 beds across nine multi-specialty hospitals in AP and Telangana as of December 31, 2020, which is 2.2 times more beds than the second largest provider in AP and Telangana.

Well positioned to consolidate in India’s large, unorganized yet rapidly growing and underserved affordable healthcare market.

- There is a significant and growing need for quality and affordable healthcare services across the country, particularly in AP and Telangana where company’s hospital network is concentrated.

- Company believes that government-backed schemes in AP and Telangana also help to set the stage for future growth.

Leading position in AP and Telangana.

- KIMS Hospital has a leading position in AP and Telangana as a provider of quality and affordable healthcare services, as well as has track record of growth and believes that company is well positioned to be a consolidator in the region.

- Company has grown from a single, approximately 200-bed hospital at Nellore in 2000 to a leading multi-disciplinary integrated private healthcare services provider with nine multi-specialty hospitals and over 3,000 beds today.

- Between Fiscal Year 2017 and Fiscal Year 2020, KIMS hospital has completed four significant hospital acquisitions, namely KIMS Ongole, KIMS Vizag, KIMS Anantapur and KIMS Kurnool, to consolidate the healthcare market in AP, growing at a pace much faster than the competing brands, in terms of year-on-year revenue growth in Fiscal Year 2020.

Disciplined approach to acquisitions resulting in successful inorganic growth.

- Company has a successful history of sourcing, executing and integrating acquisitions and has a disciplined, low-leverage approach to acquisitions that has enabled KIMS hospital to maintain the affordable pricing model as company has grown in both Tier 1 and Tier 2-3 markets.

- Company acquires hospitals that can fit into our hospital network and match our existing hospital profile in terms of specialties, technologies and healthcare professionals.

Company has a strong institutional shareholder support.

- Company’s largest shareholder, General Atlantic, is a leading global growth investor with a track record of providing strategic, practical, and impactful support to high-growth companies in India and globally.

- General Atlantic has a 40-year history of identifying emerging companies with strong fundamental performance and organic growth that can accelerate their expansion and scale.

- General Atlantic has more than $40 billion in assets under management across five global sectors: healthcare, life sciences, technology, consumer and financial services.

Financials of the Company:

| (in Crores) | FY 18 | FY 19 | FY 20 | FY 21 |

|---|---|---|---|---|

| Revenue | 700.0 | 923.8 | 1128.7 | 1340.1 |

| Net Profit | (-46.1) | (-48.5) | 115.0 | 205.4 |

Valuation of Peer Group Companies:

| Company Name | Face Value | EPS | PE Ratio | RoNW | NAV |

|---|---|---|---|---|---|

| KIMS Hospitals Ltd | 10 | 26.42 | 32.22 | 23.30% | 115.36 |

| Apollo Hospitals Ltd | 5 | 32.70 | 93.6 | 12.91% | 240.01 |

| Fortis Healthcare Ltd | 10 | 0.77 | 208.6 | 1.37% | 88.23 |

| Narayana Hrudayalaya Ltd | 10 | 5.86 | 76.8 | 10.48% | 55.99 |

| Max Healthcare Institute Ltd | 10 | 1.77 | 103.8 | 9.66% | 18.38 |

Also Read: Aster DM Healthcare Ltd Shalby Hospitals Ltd

IPO Details:

| Details | Info |

|---|---|

| Issue Opens on | 16th June 2021 |

| Issue Closes on:. | 18th June 2021 |

| Issue Price | Rs.815 – 825 |

| Face Value | Rs.10 |

| Retail Category Allocation | 10% |

| Minimum Lot | 18 Shares |

| Minimum Investment | Rs.14,850 |

| Issue Constitutes | 32.47% |

| Issue Size | Rs.2143 cr ($289 million) |

| Market Cap | Rs.6601 cr ($890 million) |

| Listing at | NSE & BSE |

| Equity Shares Offered (Fresh) | 24,24,243 |

| Equity Shares Offered (OFS) | 2,35,60,538 |

| Total Equity Shares Offered (Fresh + OFS) | 2,59,84,781 |

| Equity Shares Prior | 7,75,93,283 |

| Equity Shares after the issue | 8,00,17,526 |

Also Read : List of Upcoming IPO’s in India.

Important Dates:

| Finalization of Basis of Allotment | On or Before 23rd June 2021 |

| Initiation of Refunds | On or Before 24th June 2021 |

| Credit of Equity Shares: | On or Before 25th June 2021 |

| Listing Date: | On or Before 28th June 2021 |

Subscription Details: (Will be Updated)

| (Subscription-Category-Wise (no. of times) Till time : 06:00 PM) | Shares Offered | Day-1 | Day-2 | Day-3 |

|---|---|---|---|---|

| QIB | 77,22,708 | 0.14 | 0.32 | 5.26 |

| NII | 38,61,353 | 0.02 | 0.09 | 1.89 |

| Retail | 25,74,235 | 1.00 | 1.95 | 2.90 |

| Employee | 2,54,777 | 0.27 | 0.66 | 1.06 |

| TOTAL | 1,44,13,073 | 0.27 | 0.56 | 3.86 |

IPO Valuation Parameters:

| Earnings Per Share (EPS) | Price To Earnings ratio (PE) | Return on Net Worth (RoNW) | Net Asset Value (NAV) |

|---|---|---|---|

| 26.42 | 31.22 | 23.30% | 115.36 |

| Check IPO Allotment Status: |

|---|

KfinTech Website: http://kfintech/IPO/Allotment_StatusBSE IPO Website: https://www.bseindia.com/IPO/Allotment |

Also Read:

| Sona Comstar Ltd | Dodla Dairy Ltd |

| Shyam Metalics and Energy Ltd | Devyani International Ltd |

| Company Contact Info: |

|---|

| Krishna Institute of Medical Sciences Ltd D. No. 1-8-31/1, Minister’s Road Secunderabad – 3 Telangana 500 003, India Telephone: +91 40 4418 6000 E-mail: cs@kimshospitals.com Website: www.kimshospitals.com |

| IPO Registrar Info: |

|---|

| KFin Technologies Private Limited Selenium Building, Tower B, Plot No. 31-32 Financial District, Nanakramguda, Hyderabad, Rangareddi 500 032 Telangana, India Tel: + 91 40 6716 2222 E-mail: einward.ris@karvy.com Website: www.kfintech.com |