About the Company:

Rainbow Childrens Medicare Ltd is a leading multi-specialty pediatric and obstetrics and gynecology hospital chain in India, operating 14 hospitals and three clinics in six cities, with a total bed capacity of 1,500 beds, as of December 31, 2021.

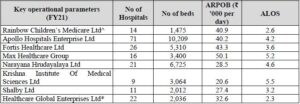

Company had the highest number of hospital beds amongst comparable players in the maternity and pediatric healthcare delivery sector, as of March 31, 2021.

Company’s core specialties are pediatrics, which includes newborn and pediatric intensive care, pediatric multi-specialty services, pediatric quaternary care (including multi organ transplants); and obstetrics and gynecology, which includes normal and complex obstetric care, multi-disciplinary fetal care, perinatal

genetic and fertility care.

As of December 31, 2021, company had 641 full-time doctors and 1,947 part time/visiting doctors.

In recent years, company has expanded the hospital network and increased our bed capacity from 1,162 beds as of March 31, 2019 to 1,500 beds as of December 31, 2021.Over the same period, company increased the number of hospitals from 10 to 14.

Company’s History:

Company established the first pediatric specialty hospital in 1999 in Hyderabad, Telangana. Since then, under the leadership of Dr. Ramesh Kancharla, our founding Promoter, company has established its reputation as a leader in multi-specialty pediatric services, with strong clinical expertise in managing complex diseases.

Company have also expanded the operations to include obstetrics and gynecology services, whereby company offers comprehensive perinatal services to patients.

Company operates on a hub-and-spoke model:

Company follow a hub-and-spoke model in Hyderabad, Telangana with Banjara Hills hospital (comprising 250 beds) being the hub and four spokes at four locations in Hyderabad, Telangana namely Secunderabad, LB Nagar, Kondapur and Hydernagar.

At the hub hospital, company provides comprehensive outpatient and inpatient care with a focus on tertiary and quaternary care and, at our spokes, we provide secondary care in pediatric, obstetrics and gynecology and emergency services.

This model has strengthened company’s market position in and around Hyderabad, Telangana providing with synergies through referrals for tertiary and quaternary care to our hub arising from the spoke hospitals.

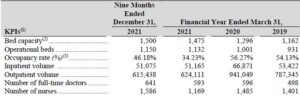

Company’s Key Parameter Indicators:

Key operational parameters of Hospitals:

- AROB: Average Revenue per Occupied Bed

- ALOS: Average Length of Stay

Management Team:

- Dr. Ramesh Kancharla (Designation: Chairman and Managing Director)

- Dr. Dinesh Kumar Chirla (Designation: Whole-time Director)

Objectives of the Issue:

Offer for Sale: (Rs.1300 cr)

- Each of the Selling Shareholders will be entitled to the proceeds of the Offer for Sale. Company will not receive any proceeds from the Offer for Sale.

Fresh Issue: (Rs.280 cr)

- Early redemption of NCDs issued by the Company to CDC Emerging Markets Limited (“CDCEML”), one of our Group Companies, in full.

- Capital expenditure towards setting up of new hospitals and purchase of medical equipment for such new hospitals.

- General corporate purposes.

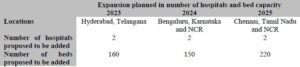

Hospital Expansion Plan:

The capital expenditure to be incurred by the Company for the purpose of setting up these hospitals. The total estimated cost of such capital expenditure, as per the quotations received from various vendors is Rs.2,44.0 crores, and company intends to utilise Rs.100 crores out of the Net Proceeds for the proposed capital expenditure.

Strong track record of growth, operational and financial performance.

- Company has grown the bed capacity from 50 beds in a single hospital in 1999 to 1,500 beds across 14 hospitals as of December 31, 2021.

- During the first decade of operations, company focused on creating the right treatment protocols, right doctor engagement model and the appropriate business model.

- Post this phase, company focused on growing the number of hospitals and bed capacity at the hospitals. Over the last six years, company has added 985 beds across 10 hospitals and have expanded the presence from two cities to six cities.

Strengthen tertiary and quaternary pediatric services in existing hospitals.

- Based on company’s 22 years of experience in operating pediatric hospitals providing tertiary newborn, pediatric intensive and pediatric sub specialty care, company believes that there is great opportunity for us to expand our quaternary care operations.

- At our hub at Banjara Hills in Hyderabad, Telangana, company commenced providing pediatric quaternary care services in 2019 and plan to build similar capabilities in our hospitals in Bengaluru, Karnataka, Chennai, Tamil Nadu and New Delhi- NCR.

Company’s Expansion Plans:

- Company plans to add additional spokes at Hyderabad, Telangana Bengaluru, Karnataka, New Delhi-NCR and Chennai, Tamil Nadu.

- Company also plan to increase the capacity of our hubs in New Delhi-NCR and Bengaluru, Karnataka. Further, company is also exploring options to grow organically in newer locations in Andhra Pradesh and Tamil Nadu.

- In addition, company is also exploring opportunities to expand in north east India and in neighboring countries. From time to time, company will also consider inorganic growth opportunities.

Financials of the Company:

| (in Crores) | FY 19 | FY 20 | FY 21 | 31st Dec 21 |

|---|---|---|---|---|

| Revenue | 551.1 | 729.7 | 660.3 | 774.0 |

| Net Profit | 44.5 | 55.3 | 39.5 | 126.4 |

Valuation of Peer Group Companies:

| Company Name | Face Value | EPS | PE Ratio | RoNW | NAV |

|---|---|---|---|---|---|

| Rainbow Children’s Medicare Ltd | 10 | 4.25 | 127.52 | 8.88% | 48.82 |

| Krishna Institute of Medical Sciences Limited | 10 | 26.87 | 54.19 | 23.74% | 111.32 |

| Apollo Hospitals Enterprise Limited | 5 | 10.74 | 428.88 | 3.30% | 320.10 |

IPO Details:

| Details | Info |

|---|---|

| Issue Opens on | 27th April 2022 |

| Issue Closes on:. | 29th April 2022 |

| Issue Price | Rs.516 – 542 |

| Face Value | Rs.10 |

| Retail Category Allocation | 35% |

| Minimum Lot | 27 Shares |

| Minimum Investment | Rs.14,634 |

| Issue Constitutes | 28.73% |

| Issue Size | Rs.1580 cr ($207 million) |

| Market Cap | Rs.5501 cr ($725 million) |

| Listing at | NSE & BSE |

| Equity Shares Offered (Fresh) | 51,66,051 (Rs.280 cr) |

| Equity Shares Offered (OFS) | 2,40,00,900 (Rs.1300 cr) |

| Total Equity Shares Offered (Fresh + OFS) | 2,91,66,951 |

| Equity Shares Prior to the Issue | 9,63,34,008 |

| Equity Shares after the issue | 10,15,00,059 |

Also Read : List of Upcoming IPO’s in India.

Also Read : List of Upcoming SME IPO’s in India.

Important Dates:

| Finalization of Basis of Allotment | on or Before 5th May 2022 |

| Initiation of Refunds | on or Before 6th May 2022 |

| Credit of Equity Shares: | on or Before 9th May 2022 |

| Listing Date: | on or Before 10th May 2022 |

IPO Valuation Parameters:

| Earnings Per Share (EPS) | Price To Earnings ratio (PE) | Return on Net Worth (RoNW) | Net Asset Value (NAV) |

|---|---|---|---|

| 4.25 | 127.52 | 8.88% | 48.82 |

| Check IPO Allotment Status: |

|---|

KfinTech Website: http://kfintech/IPO/Allotment_StatusBSE IPO Website: https://www.bseindia.com/IPO/Allotment |

| Company Contact Info: |

|---|

| Rainbow Children’s Medicare Limited 8-2-120/103/1, Survey No. 403 Road No. 2, Banjara Hills Hyderabad – 500 034, Telangana Telephone: +91 40 49692244 Email: companysecretary@rainbowhospitals.in Website: www.rainbowhospitals.in |

| IPO Registrar Info: |

|---|

| KFin Technologies Limited Selenium, Tower-B Plot 31 and 32, Financial District Nanakramguda, Serilingampally Hyderabad, Rangareddi 500 032 Telangana, India Telephone: +91 40 6716 2222 E-mail: rcml.ipo@kfintech.com Website: www.kfintech.com |